Small Business Accounting in Melbourne: A Practical Guide

Small Business Accounting in Melbourne: A Practical Guide

Starting a small business in Melbourne is an exciting journey, but managing the finances can quickly become overwhelming. This guide is designed to be your financial co-pilot, offering high-level insights and clear, practical guidance to help you navigate your obligations and drive your business forward.

Smart Accounting Is the Foundation of Your Melbourne Business

Think of solid accounting as the blueprint for your business success. It’s far more than just ticking boxes for the Australian Taxation Office (ATO); it’s the language that reveals your financial health, highlights opportunities, and informs your strategic decisions. Without a clear financial picture, making critical choices is like navigating Melbourne’s laneways with a blindfold on.

For most business owners, the daily operational demands leave little time to focus on the books. However, establishing strong accounting practices from day one is crucial. It prevents minor oversights from escalating into significant, costly problems, allowing your business to transition from merely surviving to genuinely thriving.

Why Expert Guidance Matters

Melbourne’s business environment is vibrant and competitive. Small businesses are the lifeblood of our local economy, which means they also face a unique set of financial pressures. Professional accounting isn’t a luxury—it’s an essential tool for sustainable success.

When your financials are in order, you gain the confidence to manage cash flow effectively, understand your true profit margins, and meet your ATO obligations without stress. Your numbers transform from a source of anxiety into your most valuable asset for strategic decision-making.

The importance of small business in Australia is immense. As of June 2023, of the 2.6 million actively trading businesses, a staggering 97.2% were small businesses. This trend is prominent here in Melbourne, where local enterprises fuel employment and economic vitality. With tight resources and narrow margins, their success often hinges on sharp, efficient accounting.

Ultimately, this guide aims to empower you with the knowledge to take control of your finances. We’ll cut through the jargon and explain what you need to know, from selecting the right software to finding a local expert who truly understands the Melbourne market.

Mastering Your Core ATO and Victorian Tax Obligations

Understanding your responsibilities to the Australian Taxation Office (ATO) and the Victorian State Revenue Office (SRO) is the absolute bedrock of sound financial management. It’s not just about compliance; it’s about empowering you to manage cash flow strategically and avoid costly penalties.

Your specific obligations depend on your business structure, annual turnover, and whether you have employees. Mastering these fundamentals from the outset provides a powerful foundation for growth, transforming accounting from a reactive chore into a proactive strategic tool.

As your business evolves through the launch, manage, and grow stages, its financial complexity and compliance requirements naturally increase.

To help clarify your duties, here is a high-level overview of the main tax and superannuation responsibilities you will encounter.

Key Tax Obligations for Melbourne Small Businesses

| Obligation | Who It Applies To | Typical Frequency |

|---|---|---|

| Goods & Services Tax (GST) | Businesses with a GST turnover of $75,000 or more (or those who register voluntarily). | Quarterly or Monthly |

| Business Activity Statement (BAS) | All GST-registered businesses. Also used for PAYG reporting. | Quarterly or Monthly |

| PAYG Withholding | Any business that employs staff and withholds tax from their wages. | Reported with each BAS |

| Superannuation Guarantee | Any business with eligible employees. | At least Quarterly |

| Victorian Payroll Tax | Businesses with total Australian wages exceeding $700,000 annually. | Monthly |

These are the core obligations you’ll need to manage as a business owner in Melbourne. Let’s explore what each one means for you.

Goods and Services Tax (GST)

GST is a 10% tax on most goods and services sold in Australia. As a business owner, you act as a tax collector for the government: you add GST to your prices, collect it from customers, and remit it to the ATO.

Once your business’s GST turnover (your gross income, not your profit) reaches $75,000 in a 12-month period, you are legally required to register for GST within 21 days.

Many businesses choose to register voluntarily before hitting the threshold. This allows them to claim GST credits—the GST included in the price of their own business purchases—which can significantly improve cash flow.

Business Activity Statements (BAS)

The Business Activity Statement (BAS) is the primary form used to report and pay several key taxes to the ATO.

Think of it as your regular tax report card. On your BAS, you will report:

- Goods and Services Tax (GST)

- Pay As You Go (PAYG) instalments

- PAYG withholding from employee wages

- Other taxes, such as fringe benefits tax (FBT), if applicable

Most small businesses lodge their BAS quarterly. Meeting these deadlines is critical, so mark them in your calendar. Using a comprehensive business tax return checklist is a smart way to ensure you have all the necessary information ready for each lodgement.

Payroll and Employee Obligations

Hiring your first employee is a major milestone that introduces new financial responsibilities. Fulfilling these obligations correctly is non-negotiable, as it directly impacts your team’s financial security.

Pay As You Go (PAYG) Withholding: You must withhold tax from your employees’ salaries or wages based on their earnings and Tax File Number Declaration. This amount is then reported and paid to the ATO via your BAS.

Superannuation Guarantee: You are legally required to pay super contributions for eligible employees. The current super guarantee rate is 11% of their ordinary time earnings, paid at least quarterly. The ATO enforces this strictly, with significant penalties for late or non-payment.

Victorian Payroll Tax

State-level taxes are also a key consideration. In Victoria, if your total Australian wages exceed a certain threshold, you must register for and pay payroll tax to the State Revenue Office (SRO).

For the 2023-24 financial year, the annual threshold is $700,000. Businesses that surpass this wage bill are liable for payroll tax. This is a common oversight for growing businesses that are not closely monitoring their wage expenses as they expand.

Choosing the Right Accounting Software for Your Business

Modern bookkeeping has moved beyond dusty ledgers and chaotic spreadsheets. It’s about having a real-time, crystal-clear view of your business’s financial health—like a dashboard that shows your speed, fuel level, and engine status, allowing you to navigate with confidence.

Cloud accounting software is a game-changer for Melbourne business owners. It moves your financial records to a secure, accessible online platform, empowering you to make smarter, data-driven decisions that shape your future.

Why Cloud Accounting Is a Must-Have

Cloud software automates the tedious, time-consuming tasks that used to dominate your day, such as importing bank transactions, sending recurring invoices, and chasing late payments.

This automation not only saves time but also dramatically reduces the risk of human error. The result is more accurate records, less stress at tax time, and more freedom for you to focus on what you love—running and growing your business.

For a Melbourne business, this real-time financial clarity is essential. It helps you manage cash flow during lean periods, identify trends to capitalise on, and ensure you’re always prepared for your BAS and tax obligations.

This level of financial oversight has never been more critical. Recent data shows that while Australian small businesses saw sales grow by an average of +3.0% year-over-year, 64% reported lower profits due to rising operational costs. These figures underscore how vital it is for owners to have accurate, up-to-the-minute data to navigate challenging markets.

Comparing the Top Platforms in Melbourne

For small business accounting in Melbourne, three platforms stand out: Xero, MYOB, and QuickBooks. While all handle core accounting functions, each has unique strengths suited to different business types.

Xero: Popular with startups and service-based businesses, Xero is renowned for its intuitive interface and extensive ecosystem of third-party app integrations. A creative agency in Collingwood needing seamless project management integration would find Xero a great fit.

MYOB (Mind Your Own Business): A long-standing Australian favourite, MYOB provides robust solutions, particularly for businesses with complex inventory or payroll needs. A manufacturing business in Dandenong requiring detailed job costing would benefit from MYOB’s powerful features.

QuickBooks Online: With a strong global presence, QuickBooks excels for freelancers and service-based businesses. It’s known for excellent invoicing capabilities, simple project management tools, and a user-friendly mobile app.

The right platform depends on your industry, your tech-savviness, and the strategic advice of your accountant.

Features That Truly Matter for Your Business

Beyond brand names, specific features will make the biggest impact on your daily operations. Ensure your chosen software includes these key capabilities:

Automated Bank Feeds: This non-negotiable feature automatically imports bank transactions, saving countless hours of manual data entry and reducing errors.

Single Touch Payroll (STP) Compliance: A legal requirement in Australia, your software must be STP-enabled to report employee pay and super information directly to the ATO.

Invoicing and Quoting: The ability to create professional quotes and invoices efficiently and track their payment status is fundamental to managing cash flow.

Scalability: Choose a platform that can grow with you. Does it offer advanced features you might need later, such as multi-currency support, inventory management, or project tracking?

Ultimately, the best software is the one you will use consistently. An expert can help you select the right platform and provide the training needed to maximise its value. For ongoing support with your software and compliance, our team offers professional bookkeeping and Business Activity Statement services to keep your finances perfectly organised.

Using Tax Planning to Drive Business Growth

Effective accounting extends beyond compliance; it is one of your most powerful tools for strategic growth. This is the domain of proactive tax planning—shifting your mindset from a last-minute chore to a year-round competitive advantage.

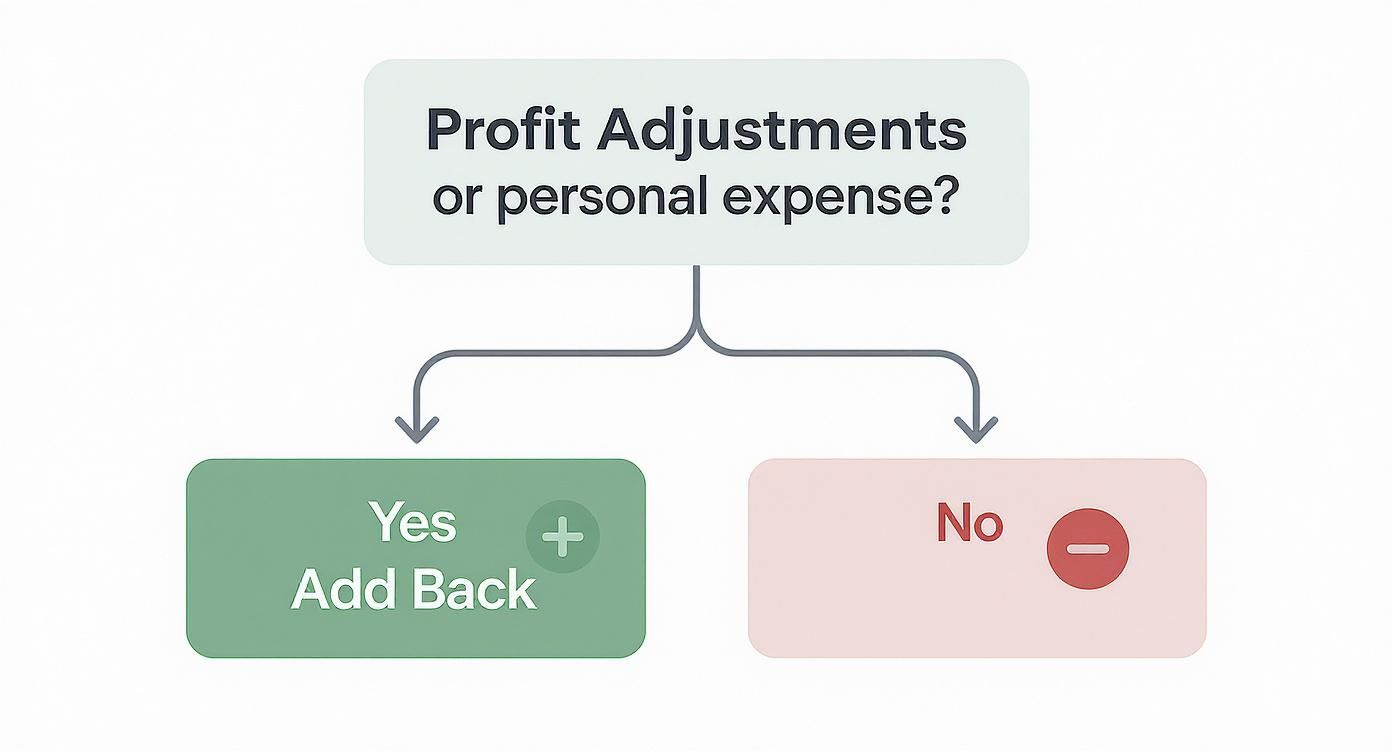

This is not about finding loopholes. It’s about structuring your finances intelligently and legally to retain more of your hard-earned capital within the business, ready for reinvestment. It is a forward-thinking strategy that aligns your financial decisions with your long-term business goals. For a growing Melbourne business, this could mean timing a major asset purchase to maximise deductions or managing cash flow to seize an unexpected expansion opportunity.

Beyond Compliance: Proactive Tax Strategies

Effective tax planning is a year-long discipline, not a frantic scramble in June. One of the most powerful strategies for many businesses is leveraging asset write-offs. For the 2023–24 and 2024–25 income years, eligible small businesses can immediately deduct the full business portion of assets costing less than $20,000.

This provides an immediate tax benefit for essential investments, significantly improving cash flow. Imagine a restaurant in South Yarra purchasing new kitchen equipment; by doing so under these rules, they can reduce their taxable income for the year, freeing up capital that would have otherwise been paid in tax.

Other powerful strategies include:

Timing Your Expenses: Bringing forward planned expenses, such as marketing campaigns or equipment maintenance, into the current financial year (before 30 June) can reduce your taxable income.

Managing Superannuation Payments: Ensure employee superannuation contributions are paid and received by the fund before the financial year-end deadline to claim the deduction for that year.

Prepaying Expenses: Certain expenses like rent or insurance can often be prepaid for up to 12 months in advance, allowing you to claim the full deduction in the current year.

The core purpose of proactive tax planning is to put you in control. By legally minimising your tax, you enhance your working capital, enabling you to hire new staff, invest in technology, or expand your operations.

Capitalising on these opportunities requires staying current with tax legislation, which is subject to change. Engaging expert tax advice and planning services provides the strategic clarity and roadmap your business needs to thrive.

Choosing the Right Business Structure

One of the most critical tax planning decisions is made at the outset: choosing your business structure. This choice has a profound and lasting impact on your tax rate, personal liability, and your capacity to grow or attract investment.

Each structure offers a different blueprint for protection, flexibility, and taxation.

Sole Trader: The simplest structure, where you and the business are legally the same entity. It is easy to set up but offers no protection for your personal assets. Business income is taxed at your marginal personal tax rate.

Partnership: Involves two or more people running a business together. Like a sole trader, it is relatively simple, but all partners are generally personally liable for business debts, including those incurred by another partner.

Company: A separate legal entity, which provides significant asset protection by separating business debts from your personal finances. Companies pay tax at a flat corporate rate (currently 25% for eligible small businesses), which is often lower than higher individual tax rates.

Trust: A more complex structure where a trustee holds assets for the benefit of beneficiaries. Its main advantage is flexibility in distributing income among beneficiaries in a tax-effective manner, making it ideal for many family-run businesses.

The optimal choice depends on your specific circumstances and future goals. A freelance consultant may start as a sole trader, but a construction business with significant assets and risk would be better protected as a company. Making the right decision from day one is a cornerstone of any effective small business accounting strategy in Melbourne.

How to Find the Right Melbourne Accountant for You

Selecting an accountant is one of the most important decisions you will make as a business owner. This relationship should be a strategic partnership that extends far beyond lodging your tax return. The right accountant acts as a trusted advisor, helping you build a more profitable and resilient business.

Melbourne is a large market with numerous accounting firms. The key is to look beyond basic tax agents and find a professional who offers forward-thinking, strategic advice. This is the difference between an accountant who merely reports on past performance and one who helps you shape the future.

Compliance vs. Advisory: What’s the Difference?

It’s crucial to understand the two main types of services available. Most business owners initially seek compliance services—the essential tasks required to keep the ATO satisfied.

Compliance services are the fundamentals:

- Preparing and lodging annual income tax returns

- Lodging quarterly or monthly Business Activity Statements (BAS)

- Ensuring payroll and superannuation are correctly managed and reported

Advisory services, however, are where a growing business gains a true strategic advantage. This is a proactive relationship where your accountant functions as a part-time Chief Financial Officer (vCFO).

Advisory services are about strategy and growth:

- Strategic tax planning to legally minimise your tax liability

- Cash flow forecasting and management advice

- Guidance on the optimal business structure for asset protection and growth

- Assistance with budgeting, financial analysis, and setting key performance indicators (KPIs)

A great firm offering small business accounting in Melbourne excels at both. They ensure you remain compliant while also challenging you to think strategically and make smarter financial decisions.

Key Questions to Ask a Potential Accountant

When you have a shortlist, the interview process is your chance to find the right fit. Ask detailed questions to understand their expertise, communication style, and service approach.

Here are essential questions to ask:

- What is your experience in my industry? An accountant who understands the specific challenges and opportunities of your sector can provide far more relevant advice.

- Who will be my primary point of contact? Knowing whether you will deal with a senior partner or a junior accountant helps manage expectations.

- What is your preferred communication method? Find a firm whose communication rhythm—whether scheduled meetings or ad-hoc emails—aligns with your needs.

- What accounting software do you specialise in? They should be experts in major cloud platforms like Xero, MYOB, or QuickBooks and be able to support you effectively.

Remember, you are not just hiring a number-cruncher; you are bringing a key advisor onto your team. Their ability to explain complex financial concepts in plain English is just as important as their technical skill.

Understanding How They Charge

Accounting fees in Melbourne vary, so it’s important to understand a firm’s pricing model to budget effectively and avoid surprises.

Hourly Rates: The traditional model, where you are billed for time spent on your work. This can be unpredictable and may discourage you from seeking timely advice for fear of incurring extra costs.

Fixed-Fee Packages: This is the preferred model for most small businesses. You pay a set monthly or quarterly fee for a clearly defined scope of services, providing cost certainty and encouraging open communication.

Value-Based Pricing: Used for specific projects like business structuring or in-depth tax planning, where the fee is based on the value and expertise delivered rather than the hours worked.

Always request a detailed proposal that clearly outlines what is and isn’t included in the fee. Transparency is a hallmark of a professional, trustworthy firm. The Australian accounting industry is projected to generate $33.3 billion in revenue in 2025, driven significantly by Melbourne’s dynamic small business sector.

Finding the right accountant is an investment in your business’s future. Take the time to find a partner who understands your vision and has the expertise to help you achieve it.

Avoiding Common and Costly Accounting Mistakes

One of the greatest advantages in business is learning from the mistakes of others. By understanding common financial pitfalls, you can save your growing Melbourne business significant time, money, and stress.

The most damaging errors often start as minor oversights driven by an “I’ll sort it out later” mentality. These can quickly snowball into major issues. Establishing strong financial habits from day one is your best defence.

Mixing Business and Personal Funds

This is the most common mistake we see. Using a personal account for business expenses or the business account for personal bills creates a tangled mess that is difficult and costly to resolve at tax time. It blurs the lines, making it impossible to accurately assess your business’s performance.

Treat your business as a separate entity with its own bank account and financial identity. This simple discipline is the cornerstone of clean bookkeeping and is essential for protecting your personal assets, especially if your business is structured as a company.

Keeping finances separate isn’t just good practice; for companies, it’s a legal requirement. It ensures every transaction is accounted for, simplifies BAS preparation, and guarantees you can claim every legitimate business deduction.

Critical Financial Oversights

Beyond mixing funds, several other common pitfalls catch Melbourne business owners unaware. These mistakes often stem from a lack of foresight and proactive planning.

Here are the most common and costly blunders to avoid:

Forgetting to Set Aside Tax Money: The GST you collect and the PAYG tax you withhold are not your funds to spend. Develop the habit of transferring a percentage of all revenue into a separate savings account. This ensures you are always prepared for your BAS and other tax payments.

Neglecting Cash Flow Forecasting: Profit and cash flow are not the same. A business can be profitable on paper but fail due to a lack of cash to pay its bills. Regular cash flow forecasting helps you anticipate shortfalls and make proactive decisions, such as chasing overdue invoices or arranging a line of credit.

Leaving Bookkeeping Until the Last Minute: A shoebox full of receipts is a recipe for disaster. Last-minute scrambling leads to missed deductions, inaccurate reports, and poor business decisions based on outdated information. Consistent, regular record-keeping is non-negotiable for financial clarity.

A little discipline goes a long way. By actively avoiding these common errors, you create the financial clarity needed to make confident, strategic decisions. A trusted expert in small business accounting in Melbourne can help you implement robust systems to prevent these mistakes from happening in the first place.

Frequently Asked Questions

When Do I Have to Register for GST?

The ATO requires you to register for GST within 21 days of your business’s GST turnover reaching $75,000 in any 12-month period. Remember, “turnover” refers to your gross business income, not your profit.

However, many new Melbourne businesses choose to register for GST voluntarily before reaching this threshold. This allows you to claim GST credits on your business expenses immediately, which can provide a significant cash flow benefit during the start-up phase.

What’s the Difference Between a Bookkeeper and an Accountant?

This is a great question, as the roles are often confused. The simplest way to understand the distinction is that a bookkeeper manages the day-to-day financial data, while an accountant uses that data for high-level strategic analysis and reporting.

A bookkeeper records all financial transactions—sales, expenses, and payments—to ensure your records are accurate and up-to-date. An accountant then uses this information to prepare financial statements, lodge tax returns, and provide strategic advice on business structure, tax planning, and long-term financial health. A healthy business needs both functions.

How Much Does a Small Business Accountant Cost in Melbourne?

The cost varies depending on your business’s complexity and the level of support you need. For a sole trader with simple affairs, a basic annual tax return may cost a few hundred dollars.

Most growing small and medium-sized enterprises (SMEs) benefit from a fixed-fee monthly package. These packages typically cover bookkeeping, BAS lodgements, and payroll support. In Melbourne, you can expect these to range from approximately $300 to over $1,500 per month. Always request a clear, detailed proposal outlining exactly what is included before engaging a firm.

Should I Find an Accountant in Melbourne?

While cloud accounting software like Xero and MYOB allows you to work with an accountant anywhere, there are distinct advantages to partnering with a local professional.

A Melbourne-based accountant understands the local economic landscape and state-specific obligations, such as Victorian payroll tax. This goes beyond compliance; it’s about having an advisor who understands the context in which your business operates.

A local expert brings more than just compliance knowledge; they bring context. Their connections and insights into the Melbourne market can be a genuine asset for navigating local challenges and seizing unique opportunities.

Get Expert Accounting Advice for Your Melbourne Business

Ready to get expert, personalised advice for your Melbourne business? The team at Brown Hamilton Partners is here to provide the clarity and strategic guidance you need to thrive.